Dear Dave,

A friend told me about your Baby Steps program. I have one question, though. I noticed that according to your plan, saving for retirement should come before saving up a college fund for your kids. Why is this?

Natalie

Dear Natalie,

In short, college funding is not a necessity. Being able to set aside money for college is a great thing to do if parents can afford that sort of thing. But you can fund your education in other ways. There are loads of scholarships out there just for getting good grades. You can also work while you’re taking classes. And one of the biggest things when it comes to getting an education is choosing a school or training program you can afford. Trust me, I believe in education. But there are lots of ways to get a college degree, or other career training, without your parents having to foot the bill or taking out student loans.

Another reason I advise this approach is because everyone is going to retire someday—unless, unfortunately, they happen to die before reaching retirement age. Retiring and eating are necessities. College is a luxury. Lots of people succeed in life without going to college, and thousands have worked their way through college. I worked 40-plus hours a week in college, and still graduated in four years. The only good way to retire is by planning for it years ahead of time, and that means saving and investing.

Sure, you should try to help your kids with their educations if you can. Even a little bit each month over the course of several years can help a lot. But some parents might not be able to put a dime toward their kids’ educations after high school. That doesn’t make them bad people or bad parents. And it doesn’t mean their kids can’t still go to college, and avoid debt doing it!

Dave

. . .

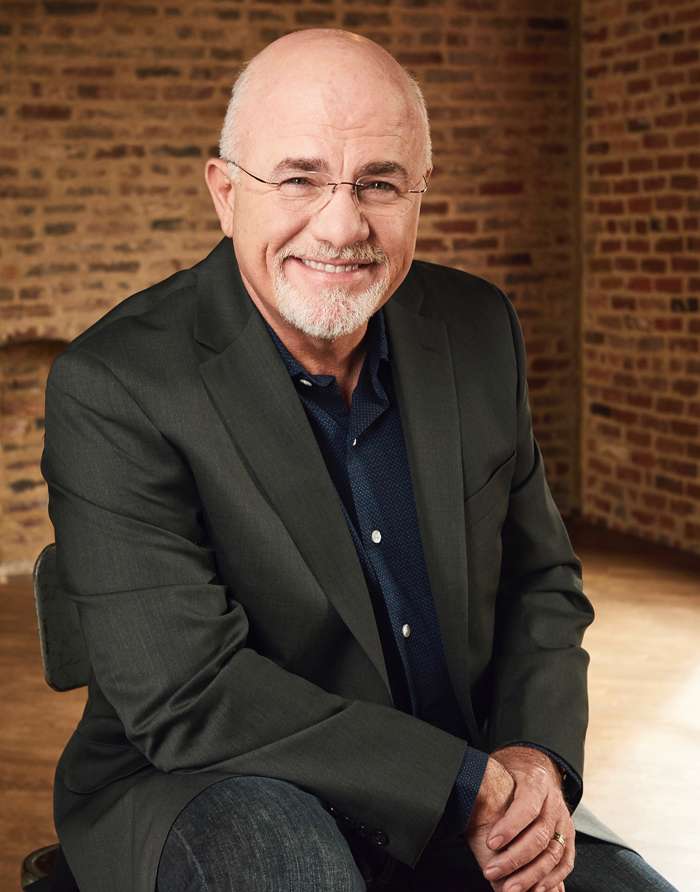

Dave Ramsey is a seven-time No. 1 national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 16 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.