Try to help him, but move slowly

Dear Dave,

My boyfriend lives in a different state, and I’m planning to move there when we get married. I know I love him, but sometimes he is not what I consider to be responsible with money. There have been times in the past when he has taken out small loans or paid bills late in order to buy something he wanted. How can I talk to him about this?

Heather

Dear Heather,

If it were me, I think I’d make sure things move a little more slowly in the relationship until he gets his spending under control. Sometimes when things like this happen it’s just a situation where a person needs to learn the benefits of budgeting and handling money in a mature, responsible way. You can’t do something if you haven’t been taught how to do it, and hopefully this is the case with your boyfriend.

You mentioned marriage, so that tells me you’re both taking this relationship seriously—that you’re in the process of making sure you want to spend the rest of your lives with each other. Bring it up gently, and tell him why you’re concerned. Share your hopes and dreams for the future with him. You might even offer to help him make out a monthly budget. That way, once he understands the process and value of spending money on paper before the month begins, it will be easier for him to stick to it.

Good luck, Heather!

Dave

Idea behind the legacy drawer

Dear Dave,

A friend recently told me about you and your teachings about money. While we were talking, she mentioned something called a “legacy drawer” for important papers. Can you explain more about this?

Anna

Dear Anna,

Simply put, a legacy drawer is a collection of your essential documents in a safe place where your family and loved ones can find them when you die, or if you’re sick or disabled. It doesn’t have to be a drawer, specifically, just a safe, secure place where you keep all the pieces of your financial life—your will, living will, estate plan, investment statements, insurance policies, and property deeds. You should also include stuff like power of attorney documents, bank and lock box access information, and any other instructions for and information about your last wishes and what you leave behind.

The stress and grief when someone becomes seriously ill or dies is bad enough. Don’t make it any harder than it has to be by leaving your finances and other essentials in a mess!

Dave

. . .

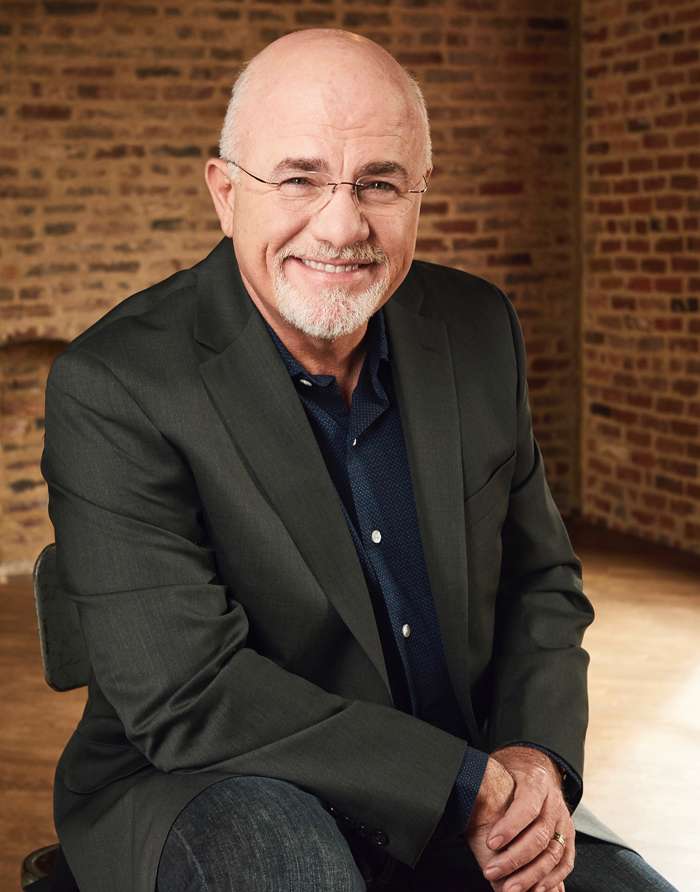

Dave Ramsey is a seven-time #1 national best-selling author, personal finance expert, and host of The Dave Ramsey Show, heard by more than 16 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.