Dear Dave,

My wife and I are having a financial disagreement. I would like to go ahead and fully fund our Roth IRAs, even though we have about $10,000 in car loan debt. She, on the other hand, thinks we should pay off the debt first. We can probably have either one completed by the end of the year. What do you think we should do?

Mark

Dear Mark,

I’ve got to go along with your wife on this one. I’m glad you two are having money discussions, and working toward making decisions together, but you’ll never get control of your finances until you rid yourself of the mindset that debt is okay. Once you lose that idea, you’ll begin to understand missing a year of funding your Roth IRAs isn’t going to kill you. It’s also not going to prevent you from becoming wealthy and living like no one else when it’s time to start thinking about retirement.

If you stay in the mindset that having debt is okay, or that you’re going to let it hang around, eventually it will really mess you up financially. Winning with money is more about behavior than math. Don’t get me wrong, you need to crunch the numbers and be mindful of them, but all the mathematical components are nothing but theory if the behavior doesn’t kick in.

So yeah, I’m siding with your wife on this one. Just follow the Baby Steps plan. Have all your debt paid off, except for your home, and an emergency fund of three to six months of expenses saved and set aside before you start any long-term investing. A lot of folks will tell you my way isn’t mathematically correct, but it will work better in the long run—for your money, your marriage, and in other areas of your life!

Dave

. . .

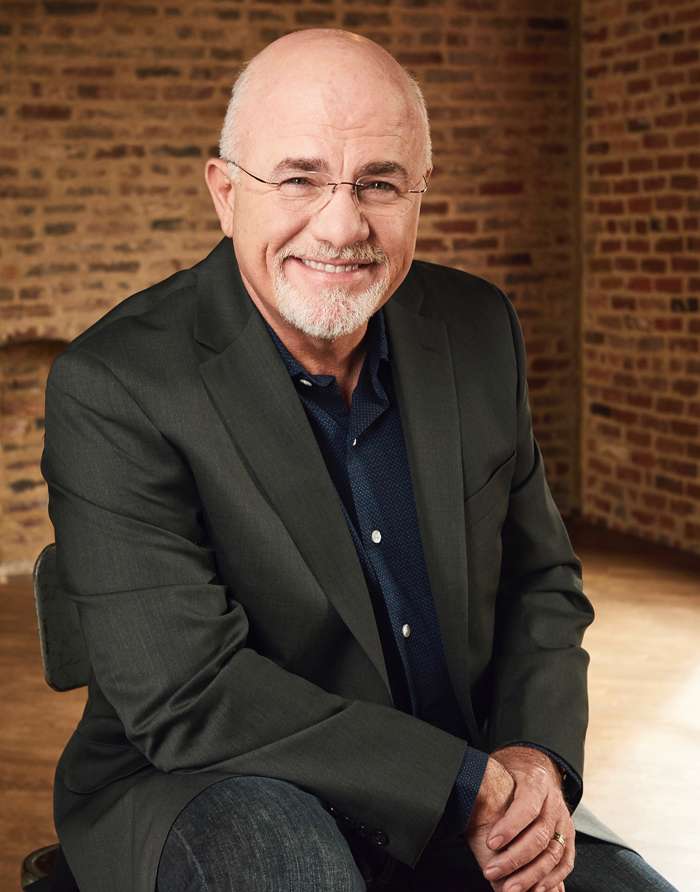

Dave Ramsey is a seven-time No. 1 national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 16 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.