Saving for a car

Dear Dave,

I decided a couple of years ago to start following your plan. Part of getting out of debt for me included paying off my car. I’m taking your advice, and saving up to pay cash for my next vehicle. I know you like mutual funds, so should I put the money I’m setting aside for that purchase in a mutual fund?

Corey

Dear Corey,

I’m glad to hear you’ve decided to get control of your money. Mutual funds are great for long-term investing, and by long-term investing I’m talking about a bare minimum of five years—preferably 10. But I wouldn’t recommend them as a way of saving up for a vehicle purchase. The problem with mutual funds, in the type of short-term scenario you’re talking about, is they can go up, or down, in value.

I’d suggest a simple savings or money market account when it comes to stashing the money you’re saving for a newer car. They don’t pay much in terms of interest, but your money will be safe, and you won’t have the ups and downs of the stock market to worry about.

Did you know the average monthly payment in America for a new car right now about $554 a month? It makes my head hurt to think about that much cash flying out the window every month on something that’s dropping in value like a rock. Even if you just stashed that kind of money in a shoebox you’d have over $6,600 saved in just a year. And despite what some people say, that’s enough to buy a dependable, pre-owned car.

Stick with the plan, Corey!

Dave

Relationships and giving

Dear Dave,

Do you have guidelines for giving when it comes to helping family members? My wife and I are both 52, we’re debt-free, and we have savings along with about $750,000 in retirement. We agree with you that it’s a bad idea to loan money to relatives, but we were hoping you could give us a little extra guidance.

Samuel

Dear Samuel,

I love that you have a helping and generous heart toward your family. Wanting to help is a noble and caring thing. Wanting to help in the best way possible for all concerned in a sign of maturity and wisdom.

The big thing is to make sure you’re helping someone get back on their feet, and make positive changes in their life. You’re not helping anyone when you give a drunk a drink, so you have to ask yourself if your generosity is really helping them or if you’re just enabling bad behavior. Also, you can’t give to a point where you’re putting your own household at risk. You have to continue to be responsible with your finances where your own family is concerned, as well.

This isn’t about being a control freak, Samuel. It’s about using the resources God has given you in a wise and responsible manner. In human terms, that means helping someone get out of a mess they’re in, while at the same time ensuring they’re working to make sure they never end up there again!

Dave

. . .

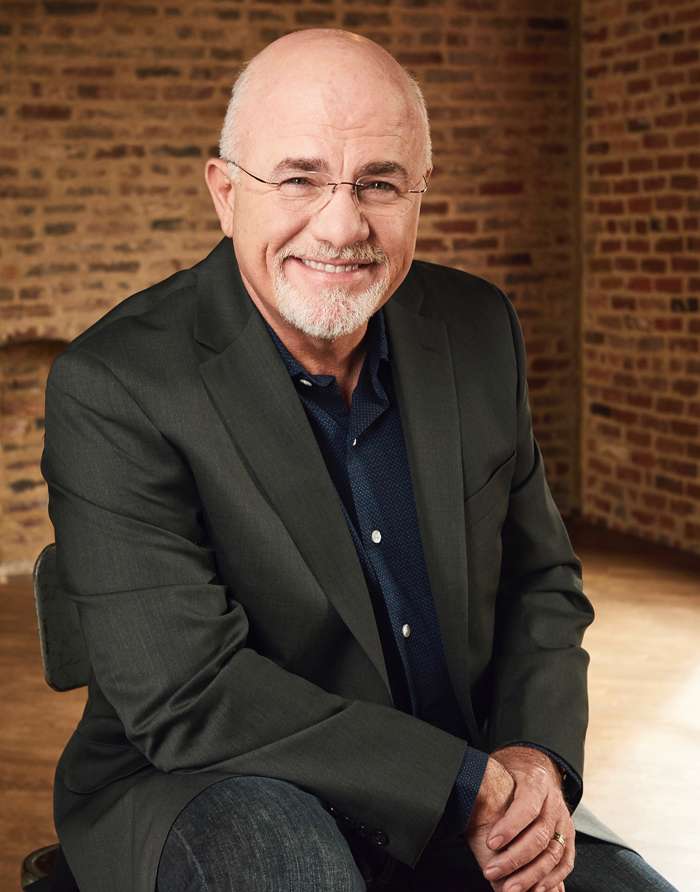

Dave Ramsey is a seven-time #1 national best-selling author, personal finance expert, and host of The Dave Ramsey Show, heard by more than 16 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.