Dear Dave,

I’m single, and I’ll be a pilot in the military for the next 10 years. I’m also debt-free, have a fully funded emergency fund, and I’m saving 15% of my income for retirement. After my military days are over, I plan to work as a commercial pilot. I’ve done the math, and I have about $20,000 a year to give, have fun with and build wealth. My question is about wealth building. When it comes to rental properties, I know you don’t like the idea of a long-distance landlord. Being in the military, there’s a good chance I’ll move around a bit. What should I do?

Rachel

Dear Rachel,

First, thank you for your service to our country. And, wow! You’re in a tremendous position financially and career-wise. You’ve got a great future ahead of you as a pilot in the military and after, plus you’ve followed my plan item by item. You’ve got so many options, and you can make a difference in your community and in the lives around you right now by giving.

When it comes to wealth building, I hope you’ve already taken advantage of the TSP, or Thrift Savings Plan, which is kind of the military version of the 401(k). For wealth building beyond that, I’d get with a good investment pro—one with the heart of a teacher—and dive into some growth stock mutual funds. You could have a lot of money piled up just by the end of your military career. Who knows? You may even be able to buy a nice home with cash when you leave the service. Beyond that, you may be able to settle into some real estate and pay cash for those investments.

You are one cool, smart lady, Rachel. Congratulations on setting yourself up for a wonderful life—one where you can live and give like no one else!

—Dave

. . .

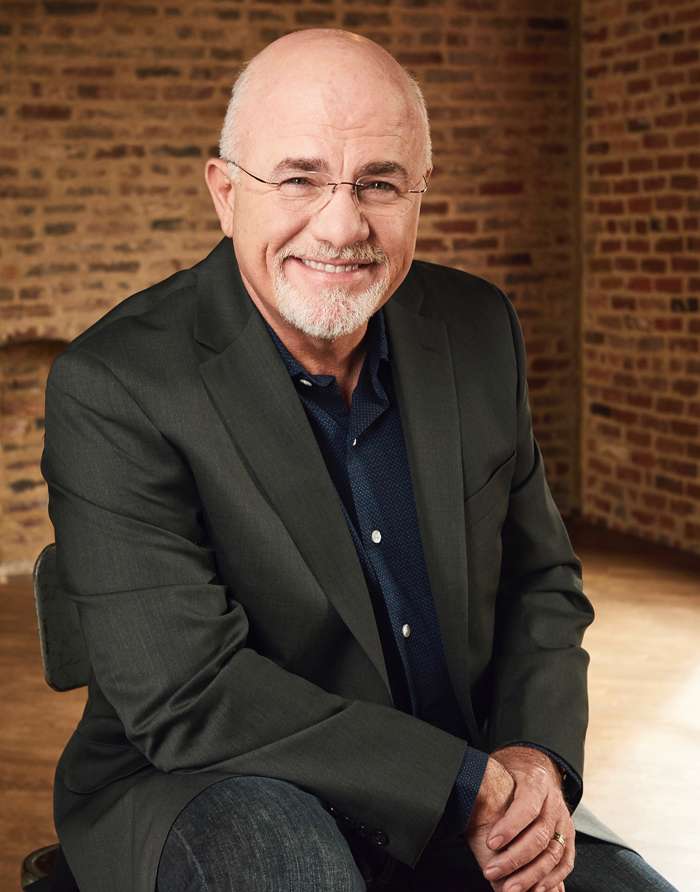

Dave Ramsey is CEO of Ramsey Solutions. He has authored seven best-selling books, including The Total Money Makeover. The Dave Ramsey Show is heard by more than 16 million listeners each week on 600 radio stations and multiple digital platforms. Follow Dave on the web at daveramsey.com and on Twitter at @DaveRamsey.