Dear Dave,

My wife and I own a small catering business. We have a few big corporations as clients, and our company has been very successful over the last two or three years. Now, we are planning to build a house. I was wondering what you think about how much should be spent on the land itself versus the construction of the actual house.

Lee

Dear Lee,

When the whole thing is done, the payment you end up with shouldn’t be more than 25% of your take-home pay on a 15-year, fixed-rate loan. The ratio of land to house can vary, and that part’s up to you. If you’re buying a big piece of land, you’re probably going to have a higher ratio of land cost to home cost than if you bought a simple lot and put a really nice home there.

Generally, a standard subdivision lot is going to be around 20% of the total price. If you spend $100,000 on the lot, you’ll end up with a total project cost of about a half-million. Now, keep in mind that’s just a fairly standard ratio. It’s not a rule.

The only rule here is my rule about mortgage payments. Again, no more than 25% of your take-home pay on a fixed-rate, 15-year note. Otherwise, you can end up house poor. And when you’re house poor, it takes away your ability to save, build wealth, and give.

Having a big house and a lot of land is cool if you can afford it, Lee. But it’s not worth it if it’s financially stressful and prevents you from living your best life!

Dave

. . .

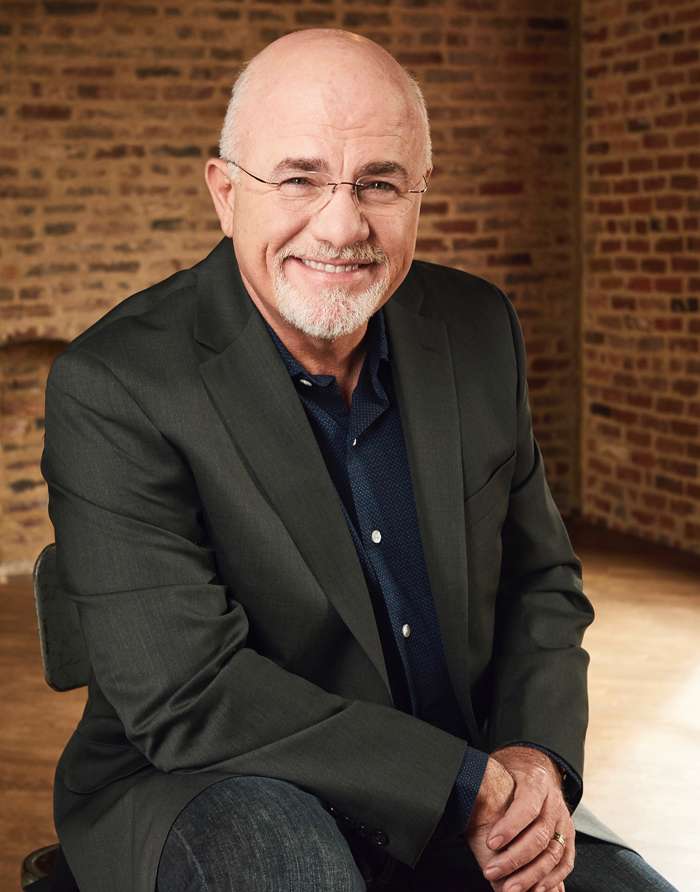

Dave Ramsey is a seven-time #1 national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 18 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.