Dear Dave,

I’m 24, single, and I make $60,000 a year. I’m also debt-free and live in an apartment, plus I have about $550,000 in a brokerage account that’s made up of 75 percent mutual funds and 25 percent single stocks. The money in the brokerage account was originally an inheritance of $280,000 that has grown since I received it in 2007. Am I putting my money toward the best investment possibilities right now?

Drew

Dear Drew,

You’re in a nice place! I’m glad you’re taking your finances and your future so seriously.

First of all, I don’t play around with single stocks. There’s just too much risk there for me. Since I don’t invest in single stocks, I don’t recommend others do it, either. I look at two things when it comes to investing—real estate and mutual funds.

I always pay cash for income-producing real estate. And when it comes to mutual funds, I invest in good, growth stock mutual funds with a solid track record of at least 10 years. Now, I don’t get mad at people if they want to dabble in single stocks a little, but I wouldn’t recommend having more than 10 percent of your investment portfolio wrapped up in them. The numbers on playing single stocks are just not that good for the individual, and besides that, I don’t like losing money!

If I woke up in your shoes, I’d move the 25 percent you have in single stocks into good mutual funds. And I wouldn’t use a brokerage account. I’d stick with a quality financial advisor, one who has the heart of a teacher. I think you’ll end up doing better with your money in the long haul this way. It might be a little boring, but boring is good when it comes to stuff like this. Exciting means you stand a good chance of losing a lot of money.

You’ve got a good income, especially for a single guy who’s 24, so I’d make those adjustments and live like the inheritance money wasn’t there. Stay away from debt, live on a reasonable budget, and make sure you’re putting 15 percent of your income away for retirement. Then, when it’s time a few years down the road, use some of that inheritance money to pay cash for a nice home.

If you can manage to do all that, the money you inherited—even with buying a home—will likely grow to millions of dollars by the time you’re ready to retire. Pretty cool situation, Drew!

Dave

. . .

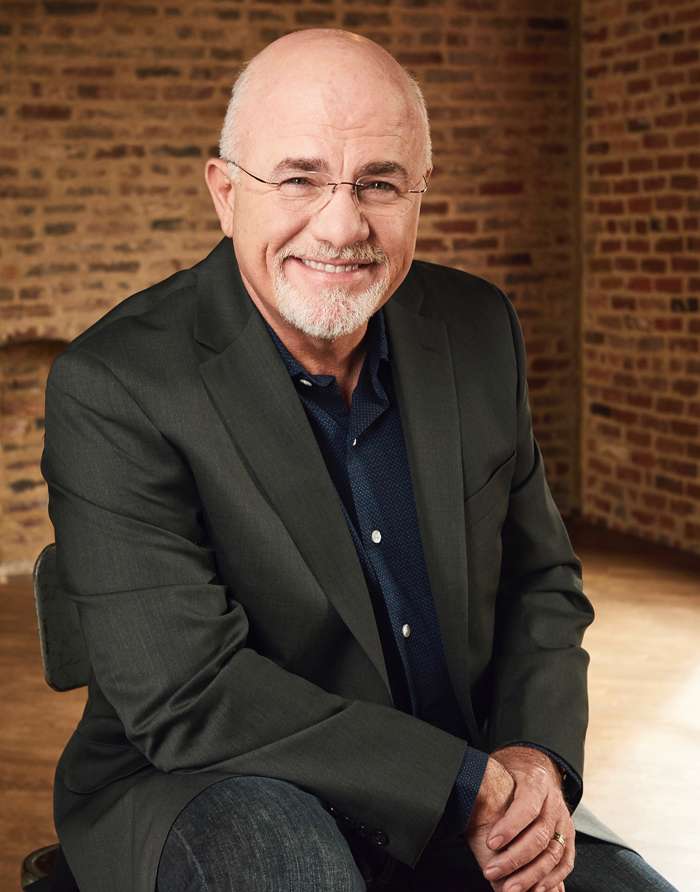

Dave Ramsey is a seven-time No. 1 national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 18 million listeners each week. He has appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.