The Trump administration is considering placing marijuana in the same federal classification as codeine, instead of where it currently is alongside heroin

BY: REBECCA RIVAS

Missouri Independent

Missouri has won praise for having one of the nation’s most robust cannabis markets. But buzz about the president’s interest in relaxing federal marijuana restrictions is raising questions about the potential impact on that economic success.

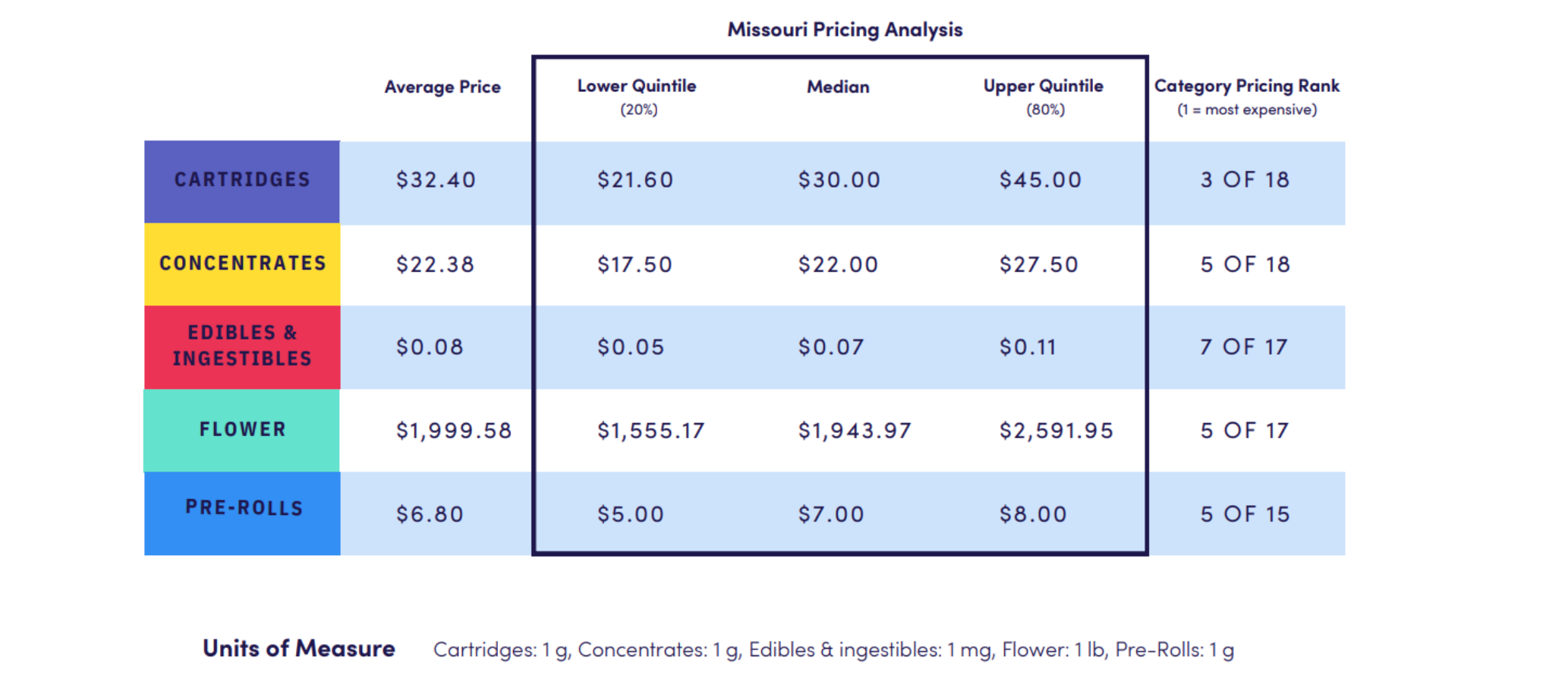

Last year in Missouri, a pound of wholesale marijuana sold for about $2,000 on average, according to the nation’s leading wholesale cannabis platform LeafLink. That put Missouri in the company’s top five highest prices.

It’s still profitable to sell a marijuana facility license in Missouri, said Ben Burstein, corporate development manager at LeafLink — a dynamic that is not true in many other states.

“You have tons of licensed operators that put millions of dollars into their businesses over time,” Burstein said of the experience in many other states. “And not only are they not making money, they have to pay to get rid of those licenses and all the closing costs associated with it.”

Experts agree the success is due, at least in part, to Missouri’s limited number of facility licenses.

Capping the number of businesses that can partake in the cannabis industry has drawn pointed criticism that it has encouraged a monopoly in the program and created the appearance of corruption. But the cap also keeps supply and demand in balance, experts say, protecting Missouri from the pitfalls others states are facing.

Oregon-based cannabis economist Beau Whitney says in other states there’s a “massive amount of oversupply” that has made it difficult for marijuana businesses to stay afloat.

A survey Whitney Economics released last year found that only 27% of cannabis companies nationwide on average were profitable in the cannabis space. And 73% were either breaking even or losing money.

Last week, President Donald Trump told reporters he plans to revisit a proposal to reschedule marijuana that started under President Joe Biden, which has been on pause since January. The plan would place marijuana in the same federal classification as codeine, instead of where it currently is alongside heroin.

“We’re looking at it,” said Trump last Monday, noting that he expects to determine whether cannabis will be reclassified in the next few weeks.

So would a push by the president to restart the plan disrupt Missouri’s ecosystem?

The short answer is yes, Whitney said, but it wouldn’t be immediate.

The process to reschedule a drug requires going through multiple drafts of administrative rules, hearings and public comment periods that could take years to accomplish.

“It’s a long process,” Whitney said. “It’s not a snap of the finger.”

It’s currently a federal crime for marijuana to cross over state lines. Would rescheduling open up the borders and allow states to sell to each other, also allowing the oversupply to bottom out Missouri’s prices?

That depends on the details in the federal rules, said St. Louis attorney Eric Walter, who represents a number of cannabis operators and the Missouri Cannabis Trade Association.

But a provision in the Missouri constitutional amendment that voters approved in 2022 legalizing marijuana was designed to control that scenario, Walter said. It states that if federal law is amended to allow interstate commerce, then only licensed cultivators could import marijuana from other states.

“They couldn’t just sell directly to dispensaries or sell directly to consumers,” Walter said. “It would still need to run through the regulated licensees, and the product would be subject to all of our specific requirements, including our testing panel.”

While it could upset Missouri’s economic impact, Walter said the financial impact nationwide would be “massive.”

Rescheduling marijuana means that the substance would be moved from Schedule 1 of the Controlled Substance Act to Schedule 3.

“Marijuana has been on 1 since the [act] was created in the early 70s,” he said, “and it never belonged.”

Medical benefits and susceptibility of addiction are taken into account when scheduling, Walter said, and Schedule 1 is for the most addictive substances with no known medical benefits, such as heroin. Cocaine is Schedule 2 because it has some medical benefits, such as numbing properties.

“It would further erode some of the anti-marijuana bias and perceptions, and open the door to banks and financial institutions interacting with industry operators more sensibly,” Walter said.

Rescheduling would also provide tax relief to businesses, he said.

Whitney calculated that this year cannabis businesses will pay about $2.7 billion more in taxes than a normal business would have paid because they can’t write off deductions on their federal taxes.

“They’re paying huge taxes to the federal government, even though it’s federally illegal,” Whitney said.

In Missouri, Burstein estimates the annual impact of rescheduling in terms of taxes to be more than $150 million in additional cash flows to operators, based on current market sales.

While rescheduling would give tax breaks, it may also increase the burden on operators to get certain certifications and occur other expenses in compliance, Whitney said. With so few operators profitable as it is, “not everybody is going to be able to survive,” he said.

The rules will have different impacts in each state. In Oregon, Whitney said all Schedule 3 drugs must be sold at pharmacies, meaning dispensaries could be out of business.

“That tax break doesn’t really help if you’re out of business,” Whitney said. “Rescheduling is maybe not the greatest thing from an economic perspective and for the industry. Even though reform is always welcome, the question then becomes, well, is the reform going to do more harm than good? I just don’t know because the reform is still in concept. It’s not even on paper.”

While President Trump said he’d take a look at it, the timing is unclear. Many Republicans, including the DEA chief Terrance Cole, are opposed to marijuana, he said.

“Operators need to remain disciplined and realize that there’s not going to be change overnight,” he said, “but be flexible enough in their processes to be able to pivot quickly once those changes happen.”